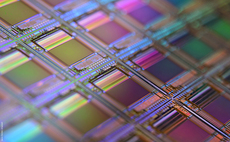

TSMC founder Morris Chang warns that keeping up with the Intels will cost a record amount

Morris Chang, the founder of contract semiconductor manufacturer TSMC, one of the world's biggest chip makers, has warned that developing 3nm process manufacturing facilities will cost the company ...

To continue reading this article...

Join Computing

- Unlimited access to real-time news, analysis and opinion from the technology industry

- Receive important and breaking news in our daily newsletter

- Be the first to hear about our events and awards programmes

- Join live member only interviews with IT leaders at the ‘IT Lounge’; your chance to ask your burning tech questions and have them answered

- Access to the Computing Delta hub providing market intelligence and research

- Receive our members-only newsletter with exclusive opinion pieces from senior IT Leaders